The Government Accountability Office recently released

its proposed framework for modernizing the U.S. financial regulatory system. The report provides a great overview of the evolution of our current, byzantine regulatory agency structure and offers some broad objectives for establishing a new structure. Here is a summary of their proposed objectives.

1. Clearly defined regulatory goals - Goals should be clearly articulated and relevant, so that regulators can effectively carry out their missions and be held accountable. Key issues include considering the benefits of re-examining the goals of financial regulation to gain needed consensus and making explicit a set of updated comprehensive and cohesive goals that reflect today’s environment.

2. Appropriately comprehensive - Financial regulations should cover all activities that pose risks or are otherwise important to meeting regulatory goals and should ensure that appropriate determinations are made about how extensive such regulations should be, considering that some activities may require less regulation than others. Key issues include identifying risk-based criteria, such as a product’s or institution’s potential to create systemic problems, for determining the appropriate level of oversight for financial activities and institutions, including closing gaps that contributed to the current crisis.

3. Systemwide focus - Mechanisms should be included for identifying, monitoring, and managing risks to the financial system regardless of the source of the risk. Given that no regulator is currently tasked with this, key issues include determining how to effectively monitor market developments to identify potential risks; the degree, if any, to which regulatory intervention might be required; and who should hold such responsibilities.

4. Flexible and adaptable - A regulatory system that is flexible and forward looking allows regulators to readily adapt to market innovations and changes. Key issues include identifying and acting on emerging risks in a timely way without hindering innovation.

5. Efficient and effective - Effective and efficient oversight should be developed, including eliminating overlapping federal regulatory missions where appropriate, and minimizing regulatory burden without sacrificing effective oversight. Any changes to the system should be continually focused on improving the effectiveness of the financial regulatory system. Key issues include determining opportunities for consolidation given the large number of overlapping participants now, identifying the appropriate role of states and self-regulation, and ensuring a smooth transition to any new system.

6. Consistent consumer and investor protection - Consumer and investor protection should be included as part of the regulatory mission to ensure that market participants receive consistent, useful information, as well as legal protections for similar financial products and services, including disclosures, sales practice standards, and suitability requirements. Key issues include determining what amount, if any, of consolidation of responsibility may be necessary to streamline consumer protection activities across the financial services industry.

7. Regulators provided with independence, prominence, authority, and accountability -Regulators should have independence from inappropriate influence, as well as prominence and authority to carry out and enforce statutory missions, and be clearly accountable for meeting regulatory goals. With regulators with varying levels of prominence and funding schemes now, key issues include how to appropriately structure and fund agencies to ensure that each one’s structure sufficiently achieves these characteristics.

8. Consistent financial oversight - Similar institutions, products, risks, and services should be subject to consistent regulation, oversight, and transparency, which should help minimize negative competitive outcomes while harmonizing oversight, both within the United States and internationally. Key issues include identifying activities that pose similar risks, and streamlining regulatory activities to achieve consistency.

9. Minimal taxpayer exposure - A regulatory system should foster financial markets that are resilient enough to absorb failures and thereby limit the need for federal intervention and limit taxpayers’ exposure to financial risk. Key issues include identifying safeguards to prevent systemic crises and minimizing moral hazard.

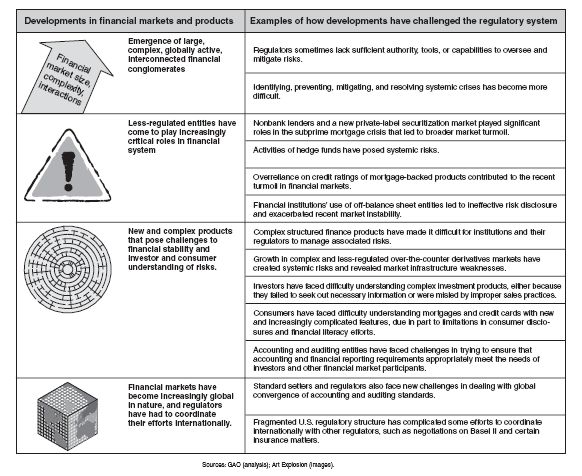

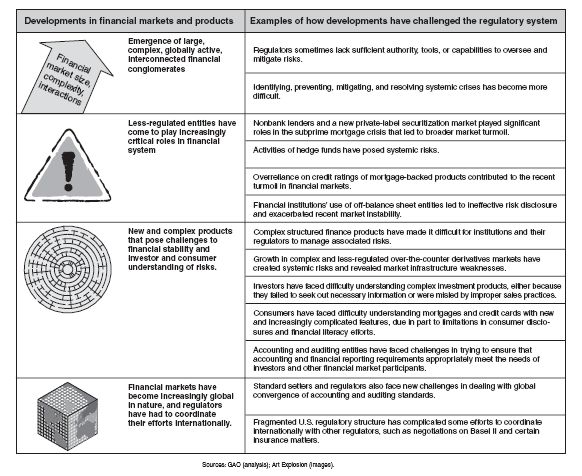

These objectives were based on the GAO's analysis (see below) of the developments leading to the current financial crisis and regulatory shortcomings.

As the report shows, it has taken more than a century to create the current regulatory structure. The change required to achieve the GAO's objectives is massive and will require strong leadership and determination to succeed.