In general, companies transfer assets from balance sheets to special purpose entities to insulate themselves from risk or to finance a large project. Under the change by the FASB, many qualifying special purpose entities will have to be moved back to a company's main balance sheet.

Outside investors often take stakes in those entities, for example, making an investment in a bank's holdings of mortgage loans in exchange for payments from borrowers. Under the new standard, companies must bring back onto their balance sheets any entity in which they hold an interest that gives them "control over the most significant activities," according to FASB. Companies must perform analyses to determine that.

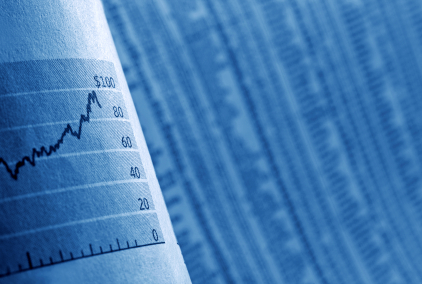

The change could result in about $900 billion in assets being brought onto the balance sheets of the 19 largest U.S. banks, according to federal regulators. The information was provided by Citigroup Inc., JPMorgan Chase & Co. and 17 other institutions during the government's recent "stress tests," which were designed to determine which banks would need more capital if the economy worsened.

The changes take effect at the beginning of 2010 and certainly will require a great deal of work on the part of financial institutions to ensure they have the necessary capital to shoulder the added burden. In addition, it will require strong quantitative and qualitative analysis to determine the need to bring assets back on the balance sheet. As a result, this change could prove to be the straw that breaks the back of some banks.