Q: What was the role of the Enterprise Risk Management ("ERM") Department and how did it relate to the overall risk management strategy in place at AIG during the time which the Financial Products unit was operating? Did the Enterprise Risk Management Department have authority to review the activities of the Financial Products unit or give approval to credit default swaps entered into by members of the Financial Products ("FP") unit?

A: Created in 2004, AIG Enterprise Risk Management ("ERM") was responsible for assisting AIG's business leaders, executive management, and board of directors in identifying, assessing, quantifying, managing and mitigating the risks incurred by AIG. The Chief Risk Officer and his team were responsible for enterprise-wide credit, market, and operational risk management and oversight of the corresponding functions at the business units. Although FP risk managers, like risk managers in some other business units, had no direct reporting lines to ERM, as discussed above, the Credit Risk Committee did review and approve most of FP's multi-sector CDS transactions with respect to credit risk and also engaged in periodic review of FP and its CDS portfolios.

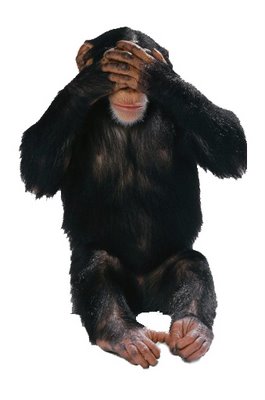

The response from AIG shows a fatal flaw in their ERM program. The risk managers in the Financial Products unit had no formal ties to the ERM organization or the Chief Risk Officer. As a result, their compensation was directly linked to the performance of the unit. This provided no incentive for them to raise red flags that may negatively impact their pay and ultimately cost them their jobs. When the valuation of the credit default swaps were unreasonably high, the risk managers simply turned a blind eye. This is precisely the situation that was described in the ERM Current™ blog post on December 19, 2008 entitled "Turning a Blind-eye Toward Risks."

No comments:

Post a Comment